Why Buy Life Insurance?

Protect the ones you love from income loss and possible financial catastrophe

Life Insurance isn't just a good idea it's a tool to protect your loved ones. It can also be a great financial investment & planning tool.

why to buy life insurance in your 20's

Why Buy Life Insurance In Your 20's?

life insurance explained

When people normally think of life insurance, they may be thinking of multiple types: whole life insurance, term life insurance, and final expense insurance.

At InvoBH, we help you understand them so you can choose the type of policy, company, and coverage amount that suits you and your family’s needs.

-

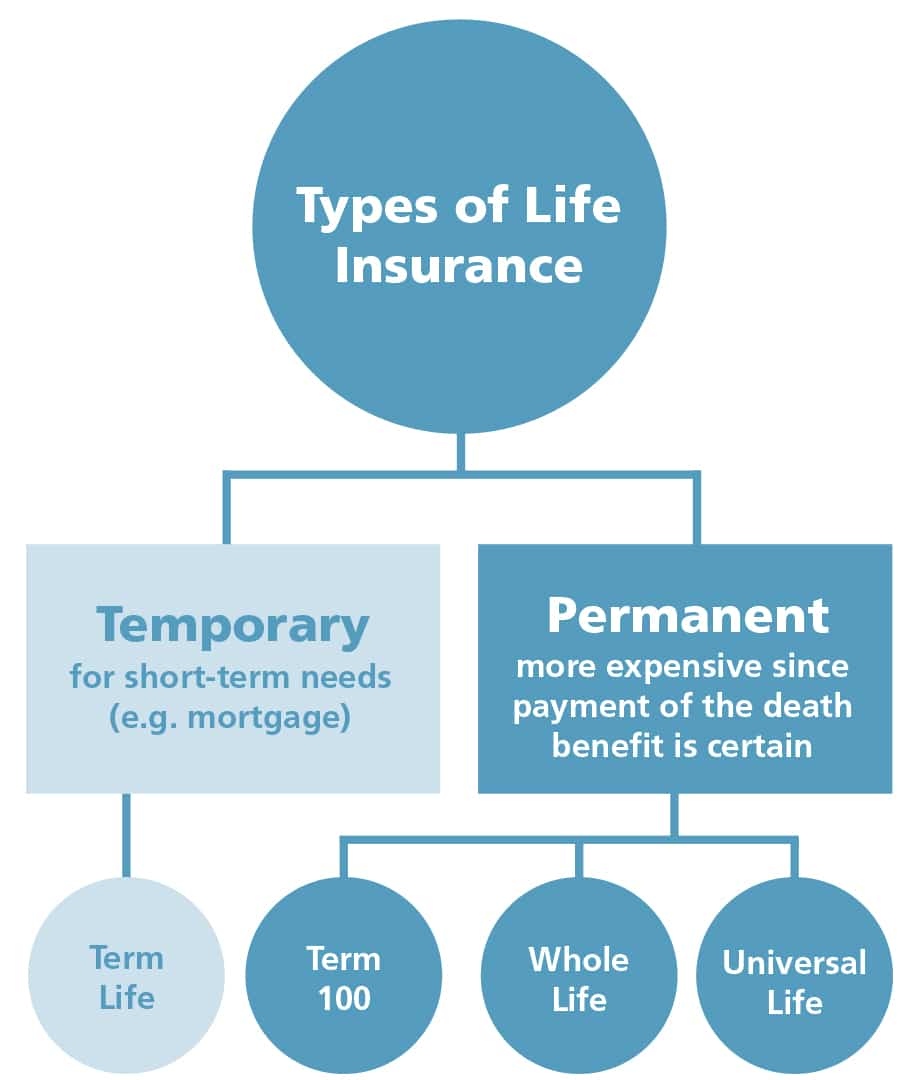

What Are The Types of Life Insurance?

There are essentially two types of life insurance policies: Whole Life and Term Life

Whole Life Insurance

Whole life insurance policies will protect your family when you pass away, regardless of timing.

Term Insurance

Term Insurance policies typically only cover you for a certain time, such as 25 years. You pay a monthly premium, and if you outlive the term, your insurance policy expires. For example, if you die after 30 years, your family will not receive a death benefit.

-

Final Expense Insurance

Final expense, aka burial insurance, is a small life insurance policy that is typically easy to qualify for. The death benefit is smaller than regular life insurance, typically anywhere from $2,000 to $50,000. Your family can use this money for anything they need, whether it be funeral expenses, outstanding bills, mortgages, or medical debt.

The major advantage of burial insurance policies is the lower monthly premium compared to standard life insurance. Burial insurance companies also typically accept those with pre-existing health conditions. People who are rejected from regular life insurance are often able to get final expense coverage to take care of their final arrangements.

Contact InvoBH for Help

Life insurance can be confusing. Choosing between different companies, types of policies, and coverage amounts can leave you feeling exhausted. At InvoBH, we can help you make smart choices easily. Call us today!

Call Us Today!whole Life insurance explained

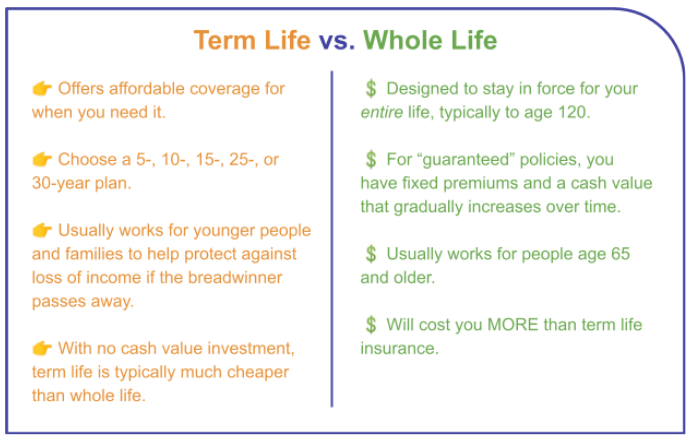

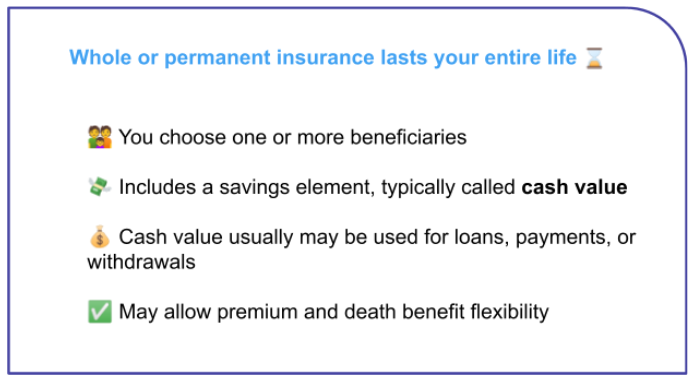

Whole life is a type of permanent life insurance. It provides lifelong coverage, and most policies feature a savings component known as cash value. Whole life insurance policies have a guaranteed rate of return, meaning the cash value will earn a minimum amount of interest.

Get In Touch Today!

-

Whole Life Overview

A whole life policy guarantees your family the death benefit.

However, it’s typically much more expensive than term life.

For a healthy applicant buying a $500,000 policy at age 40, the annual cost of whole life insurance is $5,728, compared to $315 for a 20-year term life policy.

-

Types of Permanent Life Insurance Policies

There are differences among the types of permanent life insurance policies.

- Whole life insurance - the most common type of permanent life insurance.

- Universal life insurance - offers greater flexibility than whole life.

- Variable universal life insurance - usually include many investment options that can help increase the cash value.

- Indexed universal life insurance - has no fixed interest rate on your cash value, which could lead to greater gains or losses.

Term Life insurance explained

Life insurance is a way to guarantee that your loved ones are protected when you are gone, though they can be pricey... One way to decrease the expense is by getting a term life insurance policy.

Get In Touch Today!

-

Term Life Overview

A term life insurance policy is when a company sells you a policy that will only pay your beneficiaries if you pass away within a certain number of years, referred to as the term. A typical term is 25 years, but it depends on your specific policy. If you do not pass away in that time, your loved ones will not receive that death benefit.

-

Advantages & Disadvantages of Term Limits

The benefits of these policies are that they are generally more affordable than plans that do not have a term limit. The disadvantage of this type of policy is that your loved ones will not receive any money if you do not pass away within the time frame of the term. All of the money that you had paid into the policy will have been for nothing and your family will not benefit financially.

-

How To convert from Life Inurance To Burial Insurance

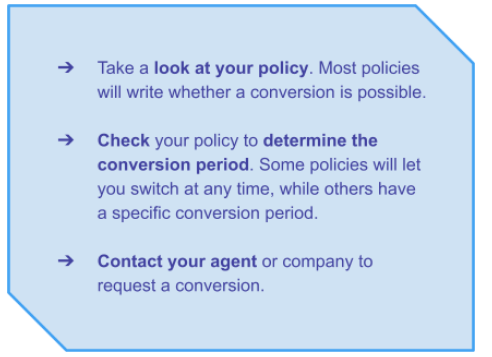

TObviously, you may want to convert a term life insurance policy. Many term policies allow you to convert to burial insurance. Converting from a term life insurance is relatively simple:

Final expense insurance explained

.jpeg)

Final expense insurance is a type of smaller life insurance policy. It is typically easier to qualify for and more affordable than regular life insurance.

Learn more about final expense insurance with InvoBH.

Get In Touch Today!-

Final Expense Overview

A burial insurance policy works like many other types of policies:

- You find an agent who helps you choose a plan and company that fits your needs

- You pay a monthly premium, and

- The policy covers your beneficiaries once you pass away

A final expense insurance policy covers costs your loved ones incur when you pass away, like funeral, bills, or medical debt.

-

Death Benefit Coverage

death benefit is the amount your family receives once you pass away. Burial policies are meant to be small, so they only have small death benefits. While a regular life insurance policy may have a death benefit between $50,000 and $1,000,000, final expense insurance policies are typically between $2,000 to $50,000.

-

Types of Plans

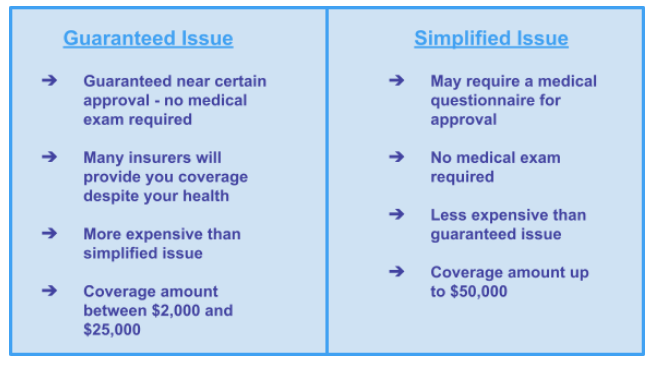

There are different types of final expense plans, which includes guaranteed issue and simplified issue plans.