What Does Your Long Term Care Look Like?

Life moves fast, prepare your future care today!

70% of people over age 65 will need some form of long term care.

LTCI provides coverage for a person who has a chronic problem and needs help with their activities of daily living. Health Insurance and Medicare will not pay for chronic care.

Long Term Care 101

Long Term Care 101

long term care explained

Many people need long-term care as they grow older, and it’s very expensive — averaging $140,000 per year if you pay out of pocket.

Long-Term Care Insurance is meant to cover long-term services and supports, including personal and custodial care in your home, a community organization, or other facility.

-

What Does It Cover?

LTC insurance normally covers services that regular health insurance does not. This may include help with completing the activities of daily living (ADLs), like bathing, eating, getting dressed, and moving around.

Long-term health insurance policies typically would repay you for these services in your home, an adult day care center, assisted living facility, or a nursing home. Some policies also pay for care related to Alzheimer’s disease and other chronic conditions.

Remember, every carrier sets rules for what types of illnesses LTC insurance will cover. These are general statements, not industry standards.

-

How Does It Work?

After applying, the insurers may ask for your medical records and inquire about your health. You can select the kind of coverage you want, but you must get approved by the insurer. When they issue you a policy, you start paying premiums each year.

Once you’re eligible for benefits, which is usually determined by not being able to perform a certain number of ADLs, and the waiting period has passed, you may file a claim. Then, the insurer reviews your medical records and might send a nurse to do an evaluation before affirming a payout. Once you’re approved, you’ll be compensated for paid services, up to policy limits.

-

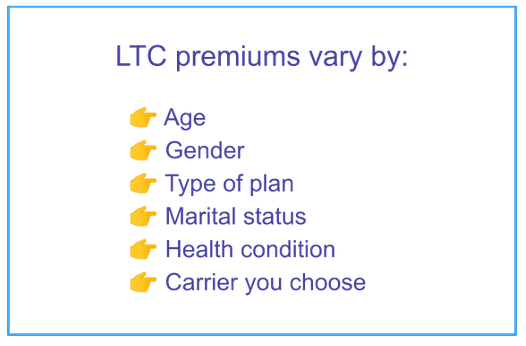

What Does It Cost?

These days, the average 65-year-old has roughly a 70% chance of needing some type of long-term care (eventually). While there’s no way to predict how much or how long you’ll need care, it would be wise to prepare for this heavy cost.

According to smartasset.com, the annual premium estimates are as follows:

- Single male, age 55 — $1,700

- Single female, age 55 — $2,675

- Couple, age 55 — $3,050 (combined cost)

Many couples can get discounts. Also, those who meet certain income thresholds may be able to get tax relief for LTC premiums. Some or all of the premiums paid may be tax deductible at the state and federal level.

-

Are There Alternatives?

Many couples can get discounts. Also, those who meet certain income thresholds may be able to get tax relief for LTC premiums. Some or all of the premiums paid may be tax deductible at the state and federal level.

Also, depending on your needs, know that Medicare Part A will cover:

- Inpatient hospital stays

- Skilled Nursing Facility Care

- Hospice Care

- Some Home Health Care (not to be confused with long-term care!)

Contact InvoBH for Help

Life insurance can be confusing. Choosing between different companies, types of policies, and coverage amounts can leave you feeling exhausted. At InvoBH, we can help you make smart choices easily. Call us today!

Call Us Today!